America’s School Choice Yearbook Superlatives

The Friedman Foundation team put in our votes, and these are our winners. Check them out and tell us how you would have voted in the comments.

Most Popular

Florida Tax Credit Scholarship Program

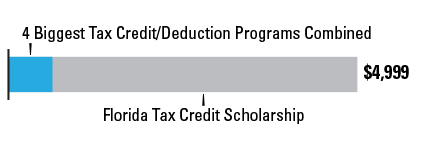

If we gauge popularity by the number of families utilizing a program with real purchasing power, Florida’s tax-credit scholarship program would be the winner. In 2014, nearly 70,000 families received scholarships worth an average $4,999 each. The only four programs with more families participating are tax credit and deduction programs, whose average funding amounts combined still make up only an eighth of the average funding amount of one Florida tax-credit scholarship.

Most Improved

Florida Tax Credit Scholarship Program

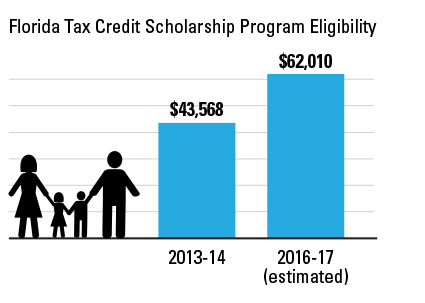

This program, the largest in terms of well-funded participation, was also the most improved when it comes to making more children eligible for scholarships. In the 2014 edition of our ABCs of School Choice, we advised policymakers that “increasing student eligibility would be a good first move” toward improving the already successful program. It seems they agreed. Policymakers increased the income eligibility guidelines for families by 42 percent. The expansion will go into effect in the 2016-17 school year.

Best Program for Students with Special Needs

Arizona Empowerment Scholarship Accounts

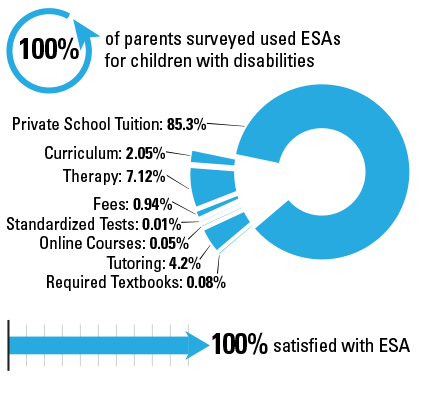

At first open only to students with disabilities, the nation’s first and largest education savings account (ESA) program was designed with the intent of allowing parents to totally customize their children’s education. ESAs allow parents to receive a deposit of 90 percent of the per-pupil funds that the state would have been spent on their children in public schools into government-authorized savings accounts, which they can use on one or multiple educational expenses. Those funds, received in the form of a restricted-use debit card, can cover private school tuition and fees, education therapies, online learning programs, specialized curriculum, private tutoring, community college costs, and other higher education expenses. Not only do ESA families of students with special needs take advantage of the program’s flexibility, they also are very satisfied with the program.

Most Empowering

Florida Personal Learning Scholarship Account Program

The nation’s second ESA program—and Florida’s third school choice program—provides the same crucial flexibility to parents as Arizona’s ESAs. What helps it edge out Arizona in terms of empowerment is its funding. Parents using a Florida ESA get 90 percent of their children’s state per-pupil funding—similar to Arizona’s—and 90 percent of what they would have received in local per-pupil funding.

Most Well-Rounded

Indiana Choice Scholarship Program

This program is the largest voucher program in terms of participation, and it has rather wide eligibility at 41 percent of families statewide, all of whom must be low-income or lower middle-income households. What sets it apart from the existing programs with, say, 100 percent eligibility or higher rates of participation, such as tax credit/deduction and tax-credit scholarship programs, is the factor of purchasing power. Currently, the average per-student funding of Indiana’s voucher program is $3,986, or 41 percent of their state per-pupil funding in public schools.

With a voucher or ESA, students are guaranteed a sum of financial assistance that gives them the means to choose schooling alternatives realistically. Compare that with how a tax-credit scholarship program works: Because government “caps” the number of tax credits distributed to donors supporting scholarship-giving nonprofits, that in turn can affect the size of children’s scholarships. For example, if requests for Florida’s tax-credit scholarships suddenly doubled, the size of each scholarship would be cut in half. That’s because there’s a capped amount of available funds for students in a given year. By comparison, if requests for Indiana’s vouchers suddenly doubled, each would still be guaranteed a voucher worth up to $4,800 in grades K-8 and $4,500 in grades 9-12. That’s not to say tax-credit scholarship programs aren’t sometimes a better option than vouchers or ESAs. For instance, they can be a good alternative in states that still have archaic Blaine Amendments, which were created in the late 1800s to keep public funding in Protestant public schools and out of predominantly immigrant private Catholic schools.

Healthiest Regulation

Arizona Education Savings Accounts

In our recent study examining the regulations on private schools and parents in school choice programs, we found Arizona’s ESA program to have the healthiest balance. The program does not bog down parents or educational providers with excess paperwork or dictate how they must run their classrooms/services, but it does require parents and the state Department of Revenue to account for where and how funds are being spent.

Biggest Legal Challenge

McCall v. Scott, a lawsuit against the Florida Tax Credit Scholarship Program

The lawsuit aims to shut down Florida’s tax-credit scholarship program that currently helps nearly 70,000 low-income children improve their education. The statewide teachers’ union, the Florida School Boards Association, the NAACP, the statewide PTA and other groups are responsible for filing the suit. Parents of children who use the program now are also fighting to intervene in the case. Because of the sheer number of low-income students who could be displaced from the schools in which they are happily learning, we named this dispute the Biggest Legal Challenge.

Most Likely to Succeed in 2015

Nevada

And by “succeed,” we mean a state that creates its first school choice program. This category was one of the most highly debated in our office, but right now Nevada appears to have the most promising path to becoming the next school choice state this year. In addition to the educational efforts being spearheaded by the Nevada Policy Research Institute, Nevada Gov. Brian Sandoval made the boldest commitment to creating a new school choice program we’ve seen yet in his 2015 State of the State address:

We will only pay for programs that make a difference in the lives of students.

I will again support Opportunity Scholarships, giving tax credits to businesses that provide tuition-based scholarships for at-risk students to attend private schools.

Through the leadership of Assemblywoman Woodbury, the Assembly Committee on Education will introduce this legislation.

I will sign it when it reaches my desk.