The States Ranked by Spending on School Choice Programs

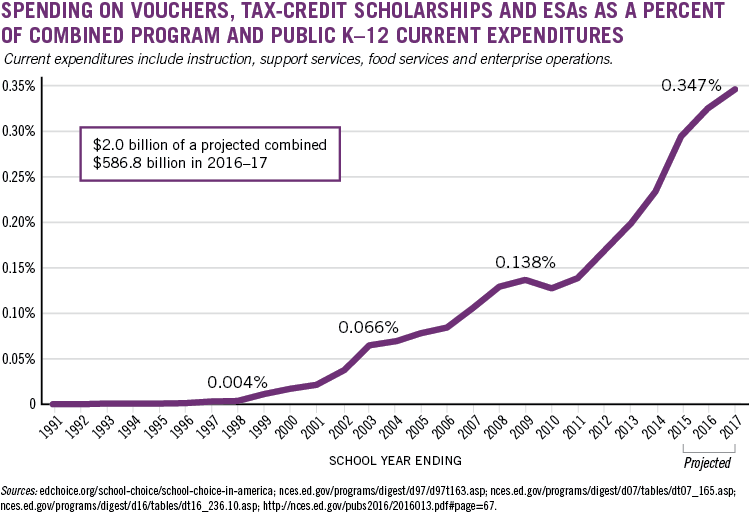

You may have noticed a new chart in this year’s edition of The ABCs of School Choice. That’s because we wanted to do something different and look at the aggregate spending on vouchers, tax-credit scholarships and education savings accounts (ESAs) in the context of national K–12 education spending.

I took the total spending data over time for each program, which is shown per ESA/voucher/scholarship on our School Choice in America Dashboard, and divided it by the combined program and public K–12 current expenditures for the entire United States over time. As you can see in the below chart, current expenditures include instruction, support services, food services and enterprise operations.

They do not include any spending for property and for buildings and alterations completed by school district staff or contractors or paying down interest on school debt. Current expenditures are for the day-to-day operation of schools and school districts, so looking at those makes for the easiest comparisons of spending that directly affects students and classroom learning.

Although I’m pretty proud of the above chart, it is only a snapshot of national spending, and you can’t really make any inferences related to state-level spending. To that end, I have provided below a ranking of states using the most recent private educational choice spending data and the most recent state expenditures available from the U.S. Department of Education.

Only the top seven states in the list actually have ESA, voucher, and/or tax-credit scholarship spending that is larger than 1 percent of combined program and public K–12 spending in that respective state. This just goes to show that private educational choice spending really is just a small drop in a large bucket, even at the state level.

1. Florida

ESA, Voucher, Tax-Credit Scholarship |3.17% of Florida’s combined program and public K–12 current expenditures | $798.7 million

2. Vermont

Voucher | 2.68% of Vermont’s combined program and public K–12 current expenditures | $44.1 million

3. Wisconsin

Vouchers (4) | 2.41% of Wisconsin’s combined program and public K–12 current expenditures | $244.5 million

4. Maine

Voucher |2.18% of Maine’s combined program and public K–12 current expenditures | $54.4 million

5. Arizona

ESA, Tax-Credit Scholarships (4) |1.83% of Arizona’s combined program and public K–12 current expenditures | $153.3 million

6. Indiana

Voucher, Tax-Credit Scholarship |1.47% of Indiana’s combined program and public K–12 current expenditures | $147.2 million

7. Ohio

Vouchers (5) | 1.33% of Ohio’s combined program and public K–12 current expenditures | $266.4 million

8. District of Columbia

Voucher |0.76% of D.C.’s combined program and public K–12 current expenditures | $12.3 million

9. Louisiana

Vouchers (2), Tax-Credit Scholarship |0.59% of Louisiana’s combined program and public K–12 current expenditures |$45.7 million

10. Georgia

Voucher, Tax-Credit Scholarship |0.42% of Georgia’s combined program and public K–12 current expenditures | $67.7 million

11. Pennsylvania

Tax-Credit Scholarships (2) |0.37% of Pennsylvania’s combined program and public K–12 current expenditures | $89.9 million

12. Alabama

Tax-Credit Scholarship |0.35% of Alabama’s combined program and public K–12 current expenditures | $23.8 million

13. Iowa

Tax-Credit Scholarship |0.33% of Iowa’s combined program and public K–12 current expenditures | $17.6 million

14. North Carolina

Vouchers (2) | 0.22% of North Carolina’s combined program and public K–12 current expenditures | $27.5 million

15. Nevada

ESA (not yet funded), Tax-Credit Scholarship | 0.16% of Nevada’s combined program and public K–12 current expenditures | $6.0 million

16. South Carolina

Tax-Credit Scholarship | 0.12% of South Carolina’s combined program and public K–12 current expenditures | $8.6 million

17. Utah

Voucher | 0.11% of Utah’s combined program and public K–12 current expenditures | $4.5 million

18. Oklahoma

Voucher, Tax-Credit Scholarship | 0.09% of Oklahoma’s combined program and public K–12 current expenditures | $4.8 million

19. Rhode Island

Tax-Credit Scholarship |0.07% of Rhode Island’s combined program and public K–12 current expenditures | $1.5 million

20. Virginia

Tax-Credit Scholarship |0.05% of Virginia’s combined program and public K–12 current expenditures | $7.4 million

21. Mississippi

ESA, Vouchers (2) | 0.05% of Mississippi’s combined program and public K–12 current expenditures | $2.1 million

22. Maryland

Voucher | 0.04% of Maryland’s combined program and public K–12 current expenditures | $4.8 million

23. South Dakota

Tax-Credit Scholarship | 0.02% of South Dakota’s combined program and public K–12 current expenditures | $0.2 million

24. New Hampshire

Tax-Credit Scholarship |0.01% of New Hampshire’s combined program and public K–12 current expenditures | $0.3 million

25. Kansas

Tax-Credit Scholarship |Less than 0.01% of Kansas’s combined program and public K–12 current expenditures | $0.3 million

26. Arkansas

Voucher | Less than 0.01% of Arkansas’s combined program and public K–12 current expenditures | $0.1 million

27. Montana

Tax-Credit Scholarship | Less than 0.01% of Montana’s combined program and public K–12 current expenditures | Less than $0.1 million

28. Tennessee

ESA | Data not yet available | N.A.