Will Wisconsin School Vouchers “Drain Billions” from Public Schools?

Wisconsin has a long and rich history of school choice, with tens of thousands of families having availed themselves of the opportunities to choose by enrolling their children in private schools. However, a legitimate concern for citizens is whether Wisconsin school vouchers will siphon resources from K–12 public schools, especially given that a vast majority of Wisconsin’s students still enroll in public schools. And with the Badger State recently expanding its statewide school choice program, concerns regarding K–12 funding have become more pronounced.

Recently, school choice opponents pounced on a memo issued by the nonpartisan Wisconsin Legislative Fiscal Bureau (LFB), which estimates the costs for the Wisconsin school voucher programs and its income tax deduction for private school tuition. By focusing on a small piece of the overall picture, some are claiming that private schools “drain billions” from the state’s school resources. This rhetoric reflects both a lack of context and a complete misunderstanding about how school finance works in Wisconsin.

The LFB memo predicts that the total cost to taxpayers for educating children in the Milwaukee Parental Choice Program (MPCP) in 2015–16 will be $197.9 million and $207.9 million in 2016–17. The estimated cost to taxpayers to educate children in the Racine Parental Choice Program (RPCP) and Wisconsin Parental Choice Program (WPCP) is $38.3 million for 2015–16 and $49.9 million for 2016–17. Thus, the estimated total cost to taxpayers to educate children in school choice programs is $236.2 million for 2015–16 and $257.8 million for 2016–17.

In addition, 2013 Wisconsin Act 20 created a tax deduction for private school tuition beginning tax year 2014. The final deductions are not available yet, but the LFB estimates the fiscal impact at $30 million per year.

| 2015–16 | 2016–17 | |

|---|---|---|

| MCPC | $197,900,000 | $207,900,000 |

| RCPC and WPCP | $38,300,000 | $49,900,000 |

| Tax deduction for private school tuition | $30,000,000 | $49,900,000 |

| Total GPR for educational programming | $5,378,395,600 | $5,856,380,100 |

| PCP and tax deductions as % of total GPR | 4.95% | 4.91% |

Opponents usually stop there, but this information is meaningless without context. According to 2015 Wisconsin Act 55, the total General Purpose Revenue (GPR) allocated to educational programming will be $5.38 billion in 2015–16 and $5.86 billion in 2016–17.

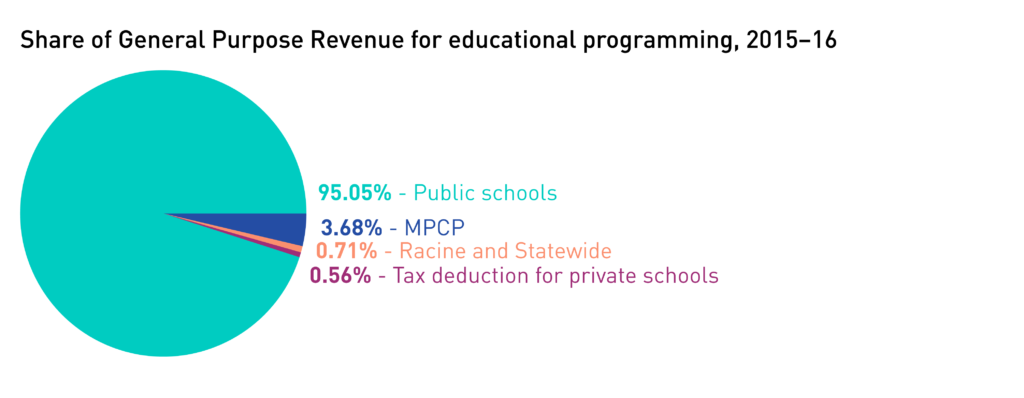

That means spending on the MPCP will comprise only 3.68 percent of GPR. The RPCP and expansion of the statewide program, which generated substantial controversy and many exaggerated claims throughout the budget process, takes up only 0.71 percent of GPR. And the private school tuition tax deduction takes only about one half of one percent. Together, these programs make up less than 5 percent of total GPR (most of it concentrated in Milwaukee).

Therefore, 95 percent of Wisconsin’s education spending will continue to funnel to public schools, while only 88 percent of the state’s school-aged children actually attend those schools.

There is still more to the story.

As a recent report by the Wisconsin Institute for Law & Liberty (my former employer) shows, public school districts in Wisconsin can actually benefit financially when students leave through a voucher program. Not only are the schools held harmless for serving students who leave, but also they keep a generous portion of the revenue attached to those students. In other words, the dollars do not entirely follow the child.

Some of the money the school would have received for a choice program participant remains in the districts’ pockets. The reason? When a student from a public school uses a voucher to enroll in a private school, the originating school district is allowed to continue to count that student for general state aid and revenue limit* purposes — even though the district is no longer required to educate the child.

No other enterprise in our economy operates like this. For example, if a college student at the University of Missouri (MU) chooses to transfer to the University of Kansas (KU), MU does not keep any portion of the tuition charged by KU.

Essentially, school districts in Wisconsin receive a “school choice bonus” if their students choose to use vouchers to enroll in private schools.

Here’s how it works:

Currently, a voucher is worth up to $7,210 for students in grades K–8 and up to $7,856 for students in grades 9–12. That amount is equal to about 58 percent of the average cost to educate a student in a public school, according to the Wisconsin Dept. of Public Instruction’s comparative cost data. So, school districts that lose students to the parental choice program actually end up with more revenue for each student who remains in their schools.

The revenue limit varies by district, but the minimum is $9,183—nearly $2,000 above the cost to educate a student in the Wisconsin voucher programs. Districts are allowed to pocket the difference between the revenue limit and voucher amount, which can amount to several thousand dollars per choice program participant. That money can then be directed back to the district or school budget, benefiting students who remain in the public school. Even though the size of the district’s pie becomes proportionally smaller, the slice for each student choosing to remain in the district gets bigger. In other enterprises (like higher education), the slice remains the same when firms lose customers.

To the extent that the “school choice bonus” can more than cover a district’s fixed costs, school choice in Wisconsin can actually improve the fiscal health of districts. Economist Ben Scafidi recently argued that school choice does not necessarily lead to fewer resources for students remaining in public schools. His earlier research also documented the portion of total costs that are fixed and variable. For schools in Wisconsin, fixed costs comprise a much smaller share, about 35 percent. Notably, these costs eventually become variable after several years.

Of course, children enter and leave schools and school districts for many reasons. When families move out of a district, for instance, the district loses dollars tied to any of the students whose families have moved. This type of choice is actually more disruptive to the budgets of school systems because districts lose more revenue if their students move to different public schools than if they use vouchers. So why is this type of choice acceptable to opponents, while school vouchers and private school tuition tax deductions are not?

It is clearly not the case at all that school choice “drains billions” from public schools. Instead, in addition to providing benefits for children, school choice provides cost savings and frees up district resources, leaving more resources for the students who remain. Isn’t that a policy worth getting behind?

____________

*The state Legislature determines how much revenue a district can raise through revenue limits. The revenue limit is an amount that a district is allowed to levy in property taxes. The way it has worked in the past, it declines when membership declines and rises when membership increases. Districts may raise property taxes to exceed its revenue limit only through referendum.