Does School Choice Rob from the Poor to Give to the Rich?

“…[I]t may surprise you to learn that in a growing number of states, legislators are setting aside public money to pay for private school tuition – and rich people are benefiting,” Valerie Strauss wrote last year on The Washington Post’s website.

Actually, the WaPo education writer’s class-warfare demagoguery should surprise readers more, particularly when it is confronted with the facts, which were available before the publishing of her 2013 article. And because “facts are stubborn things,” recently released data further erode Strauss’s attempts to drive a wedge between Americans on school choice.

Looking at the school choice program on which Strauss focused—called tax-credit scholarships—only one state’s is open to every student, regardless of income level or school assignment: Arizona’s Original Individual Income Tax Credit Scholarship Program.

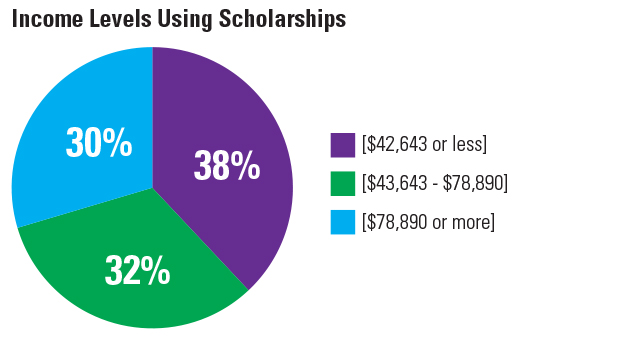

Data from the Arizona Department of Revenue’s FY2013 report on that program show even when “rich people” are eligible for school choice, it’s still low- and middle-income families who overwhelmingly benefit:

- In 2012, more than 70 percent of the aforementioned program’s scholarship funds went to students in families earning less than $78,890 annually. The national median family income then was $62,527 ($76,035 for married-couple families). That represents an increase from the year prior when 68.5 percent of scholarship funds went to students from families earning less than $76,494.

- Among students who qualify for free and reduced-price lunch, 36.8 percent of the scholarship funds went that population in FY2012. That number increased to 38 percent in FY2013.

Moreover, in 2012 Arizona launched a supplement to its original tax-credit scholarship program specifically designed to assist families with greater financial need. The program encourages individuals—Strauss’s “rich”—to donate even more to scholarship-granting nonprofits once they’ve maxed out their donations to the original program. Although the available scholarship funds for the “switcher” tax credit are a little over one-tenth what they are for the original program, a larger portion of the scholarship funds go to students from families with low to moderate incomes.

Indeed, in FY2013, more than 74 percent of the switcher scholarship funds went to students from families earning less than $78,890 annually, with more than 39 percent of the scholarship funds directly benefitting students who qualify for free and reduced-price lunch.

On a personal note, Strauss also should be careful about generalizing that only “rich people” support school choice. After all, I donate to my local scholarship-granting nonprofit. Yes, even graduate students up to their ears in student loan debt can set aside some money to help less-privileged children get a better education.

Although being wealthier would be nice, giving disadvantaged children a chance to succeed is just as rewarding.