School Vouchers Gone Wild? The Truth About Florida’s Tax Credit Scholarships

Based on recent media coverage, you might get the impression that the Florida Tax Credit (FTC) Scholarship Program operates in some kind of Mad Max free-for-all, where families are routinely exploited by ne’er-do-well school operators. An editorial in the Orlando Sentinel decried “your tax dollars” being “whisked away” to private schools and called for an “overhaul” of this “little regulated system.”

Journalism is a great and powerful tool that can be used to shine light on misdeeds and injustice. A few examples of private schools engaging in less-than-stellar behavior should not be the standard we use to condemn all private schools and an entire program that’s helped hundreds of thousands of students. After all, when media exposes fraud or sexual misconduct in a public school, we, as a society, don’t accept when those instances are generalized to the whole of public schools.

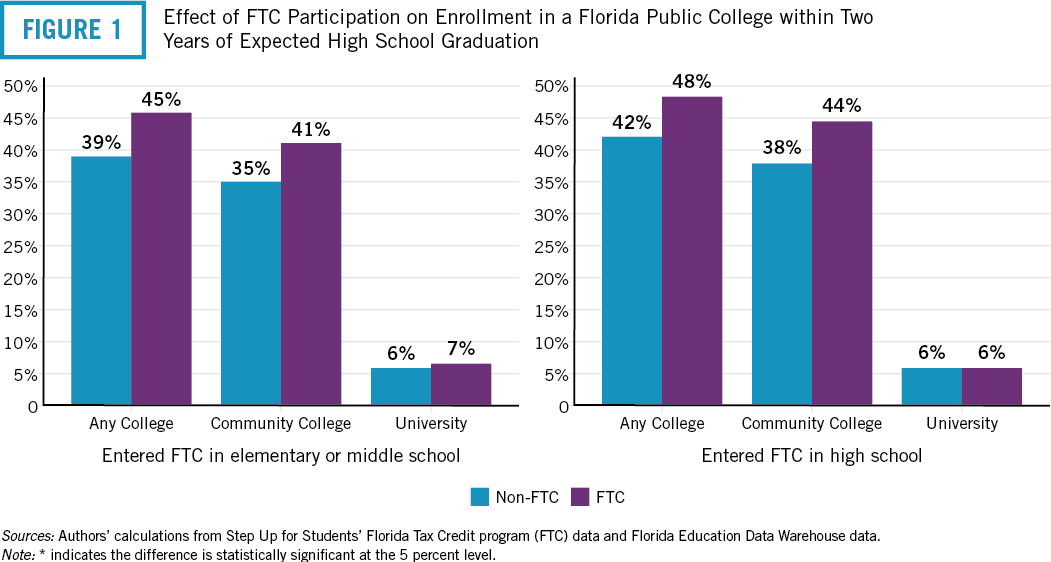

The facts paint a very different picture of Florida’s school choice program: Recent research shows it actually increased the college enrollment rates of participating students. The authors Matthew Chingos and Daniel Kuehn followed more than 10,000 FTC students and matched them with demographically-similar non-FTC students, and they found that FTC students enrolled in college at a rate approximately 6 percentage points (or 15 percent) higher than their public school peers.

Here is the key figure from that paper:

Two year colleges, four year colleges, students who have been in the program for a long time, students who have been in the program a short time—across the board we see clear benefits for those who participate in the FTC program.

But if that isn’t enough, one of the authors of that research, Chingos, is back with a fresh analysis of FTC data that again rebuts the narratives around the FTC program.

In the initial analysis of college enrollment rates, Chingos and Kuehn found that different categories of schools had different effects on college going rates. Catholic schools, for example, were particularly strong at increasing college enrollment, while non-religious private schools were not. Schools with large numbers of FTC students, on average, produced lower rates of college enrollment.

This offered the opportunity for a follow-up analysis, the results of which were recently published by the Brookings Institution, that answers the question: Are parents being sucked into lower performing schools?

Fears that families in “unregulated” private school choice programs will be hoodwinked into attending low-quality schools are legion amongst school choice opponents, and Chingos’ data can help test whether or not that actually happens.

It doesn’t.

As Chingos begins his conclusion, “This analysis indicates that participation in the FTC program has not shifted toward schools with weaker track records of improving student outcomes, as measured by two broad categorizations.” Students are neither disproportionally enrolling in the religious (or non-religious) schools that are linked to lower college going rates nor disproportionally enrolling in schools with large numbers of FTC students.

What’s more, regulations are not all they’re cracked up to be. Take Louisiana, widely considered one of the most heavily regulated school voucher programs in the country. In that program, participating students have to take the state’s achievement tests (in Florida, schools can choose to administer a nationally-recognized norm-referenced test) and schools have to participate in the state’s accountability program (they don’t in Florida). Louisiana is also the locus of the only randomized control trial of school vouchers that found a negative result for participating students. Now, student achievement has gone up in the following years, and we cannot hang poor performance on regulation alone, but it should give us pause when we reach for regulation as a cure-all for programmatic issues.

Families are not being hoodwinked. While not always gravitating to the highest-performing schools (measured on this one metric, to be fair), they are not moving toward lower-performing schools.

School leaders, non-profit organizations and state policymakers can do more to help give parents better information about the choices that they are making. But even absent that information, and the heavy regulations that often accompany it, the Florida Tax Credit program is having a positive effect on students, and families are not moving to lower-quality options. If you don’t believe me, listen to this incredible testimony by Denisha Merriweather, a FTC program graduate who now works at the US Department of Education. She was able to find a school that served her better than the options available to her in the public system, and is living a better, happier life as a result.